Vela and the Rise of WhatsApp-First Payments in South Africa

In South Africa, WhatsApp has quietly become the most natural place for people to interact with businesses. It's where conversations already happen, where trust already exists, and where people feel comfortable making decisions. What's changed recently is not the behaviour of users, but the capability of the platform itself. With the rapid evolution of the WhatsApp Business API, WhatsApp is no longer just a communication channel — it's becoming a place where real actions and real transactions can happen.

This shift is exactly what makes Vela possible.

For a long time, sending or receiving money digitally meant friction. Users were pushed to download banking apps, redirected to unfamiliar payment pages, or asked to complete forms on slow websites. Every extra step reduced trust and increased drop-off. In South Africa especially, where data costs, device limitations, and app fatigue are real concerns, that friction has always been a barrier.

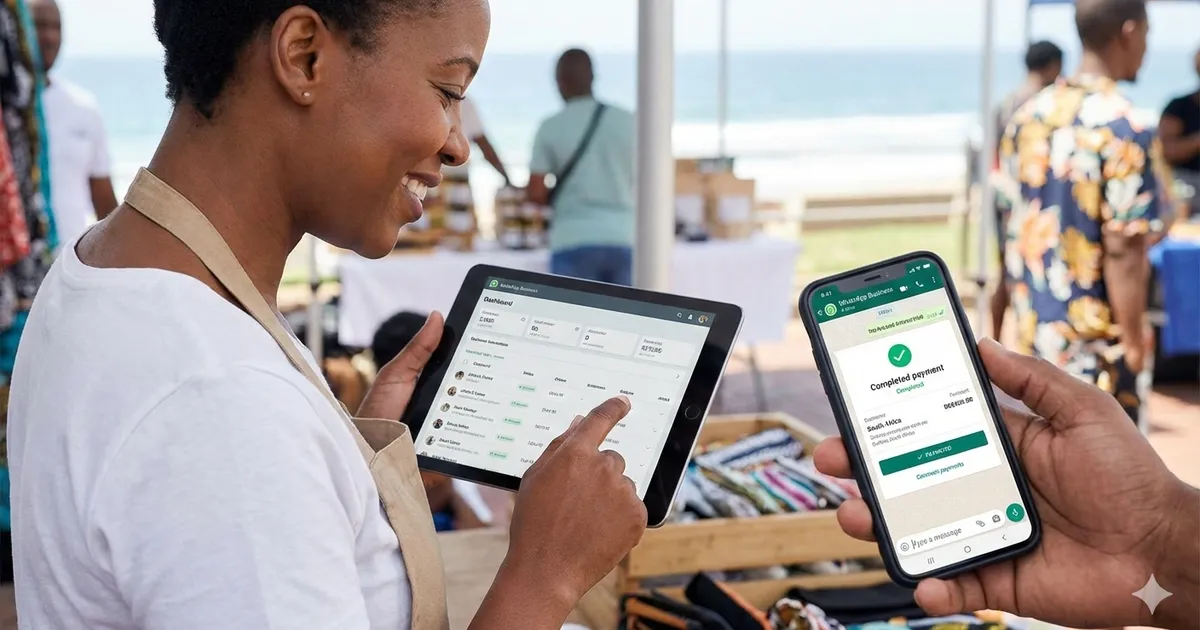

Vela takes a different approach. Instead of asking people to change their behaviour, it builds directly on top of behaviour that already exists. By integrating payments and payment-related actions into WhatsApp conversations, Vela allows people to send, receive, confirm, and manage payments inside a space they already use every day. There's no new app to install, no new interface to learn, and no additional notifications to configure. If you can use WhatsApp, you can use Vela.

What makes this possible is how powerful WhatsApp's newer Business API features have become. Conversations are no longer just free-text messages. They can include guided flows, structured responses, and clear actions. A payment request doesn't feel like a technical process — it feels like a message. Confirmation doesn't arrive as an email buried in an inbox — it arrives as a WhatsApp message you were already expecting.

From a user's perspective, this simplicity matters. Whether it's a small business owner requesting payment, a freelancer getting paid, a buyer and seller transacting, or a family member sending money, the experience feels familiar and immediate. Trust is reinforced because everything happens inside a platform people already associate with real conversations and real people.

From a developer and business perspective, the benefits are just as significant. Traditional payment products require heavy investment in mobile apps, UI design, push notifications, and ongoing infrastructure just to ensure users see and respond to actions. WhatsApp removes most of that complexity. Notifications are already enabled by default. The interface is standardised and consistent across devices. Design decisions are minimal because the interaction patterns are already well understood.

This allows platforms like Vela to focus on what actually matters: secure payment logic, compliance, reliability, and scale. Instead of spending time and money recreating interfaces and notification systems, development effort can go into making transactions safer, faster, and more accessible to more people.

The broader impact of this model is hard to ignore. When payments move into WhatsApp, they become more inclusive by default. People who might never download a dedicated finance app can still participate. Small businesses don't need complex systems to accept payments. Informal transactions become more structured without becoming more complicated. Entire layers of digital exclusion start to fall away simply by meeting people where they already are.

This is why WhatsApp's evolution matters so much in the South African context, and why products like Vela feel inevitable rather than experimental. WhatsApp is quietly becoming an interface layer for daily life — not by replacing existing systems, but by connecting to them in a way that feels human and simple.

The future of payments in South Africa doesn't need to look like another app on a crowded home screen. It can look like a conversation. And for many people, that future already lives inside WhatsApp.